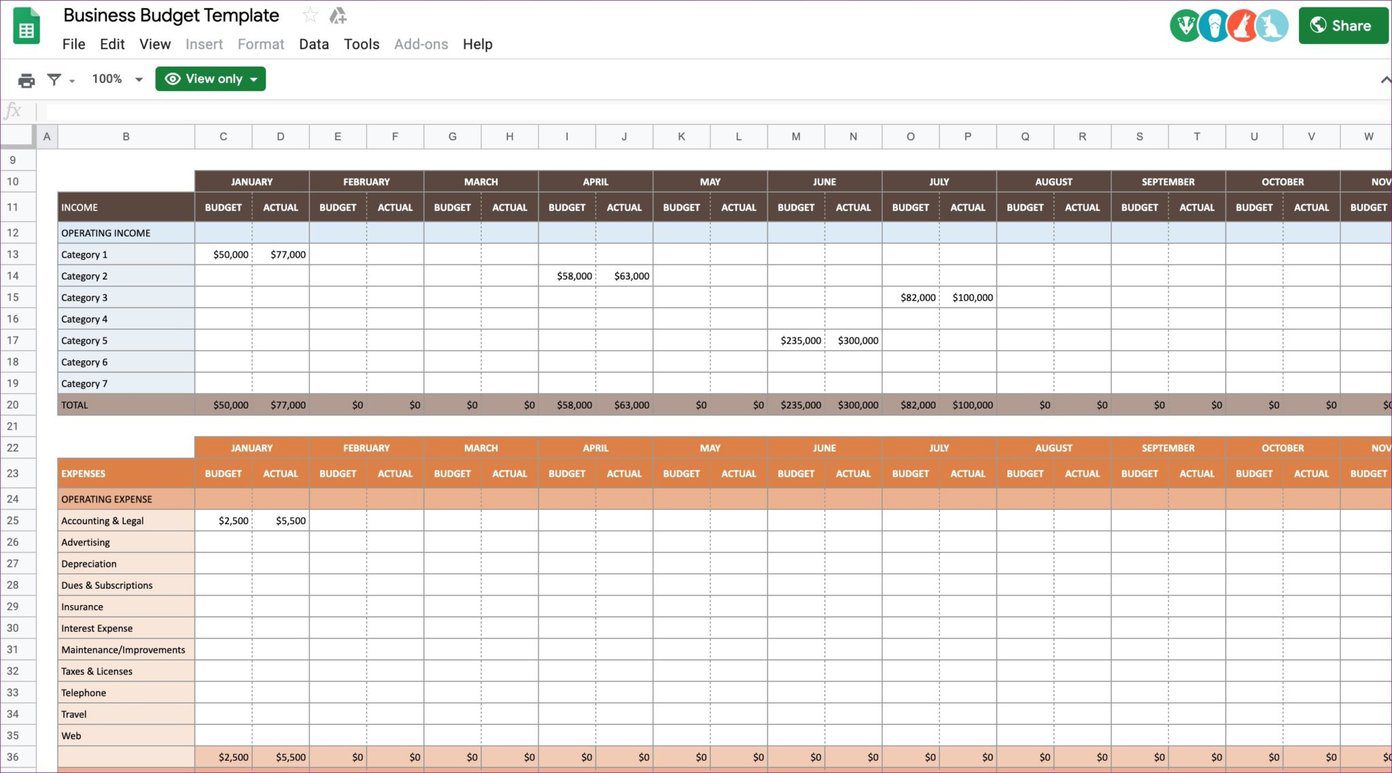

The "Deductible" column on the mileage ledger, tells the spreadsheet whether it's an expense that can be deducted or not, and whether it's deductible in addition to the standard mileage deduction, or only when claiming actual expenses instead.Ġ or blank means it's not deductible. Mainly the Week, Date, and Amount/Odometer Start/Odometer End fields are mandatory. Some fields, notably the fields that allow you to record locations, are optional. There are dummy entries in the Main/Mileage/Expense Ledger tabs, to show you the format.

They're just doing intermediate operations that the Report tab draws from. Don't touch the "Scratch" tab, or any of the "Filtered" tabs. To use it, just set the configuation values on the Configuration tab (Tabs are at the bottom), and then enter each delivery into the Main Ledger tab, your trip miles into the "Mileage Ledger" tab, and your Expenses into the "Expense Ledger" tab. You'll need a google account so you can make a copy of the spreadsheet to your own google drive. The sheet does the math for you, so you can see which deduction method will be better for you. This is just a really simple spreadsheet I made for tracking my earnings, doublechecking Doordash's math, tracking my expenses, and figuring out how much tax I owe, after mileage deduction or itemized expense deductions.

0 kommentar(er)

0 kommentar(er)